monterey county property tax rate 2021

Download all California sales tax rates by zip code. The California state sales tax rate is currently 6.

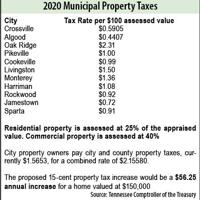

15 Cent Property Tax Increase Ok D Local News Crossville Chronicle Com

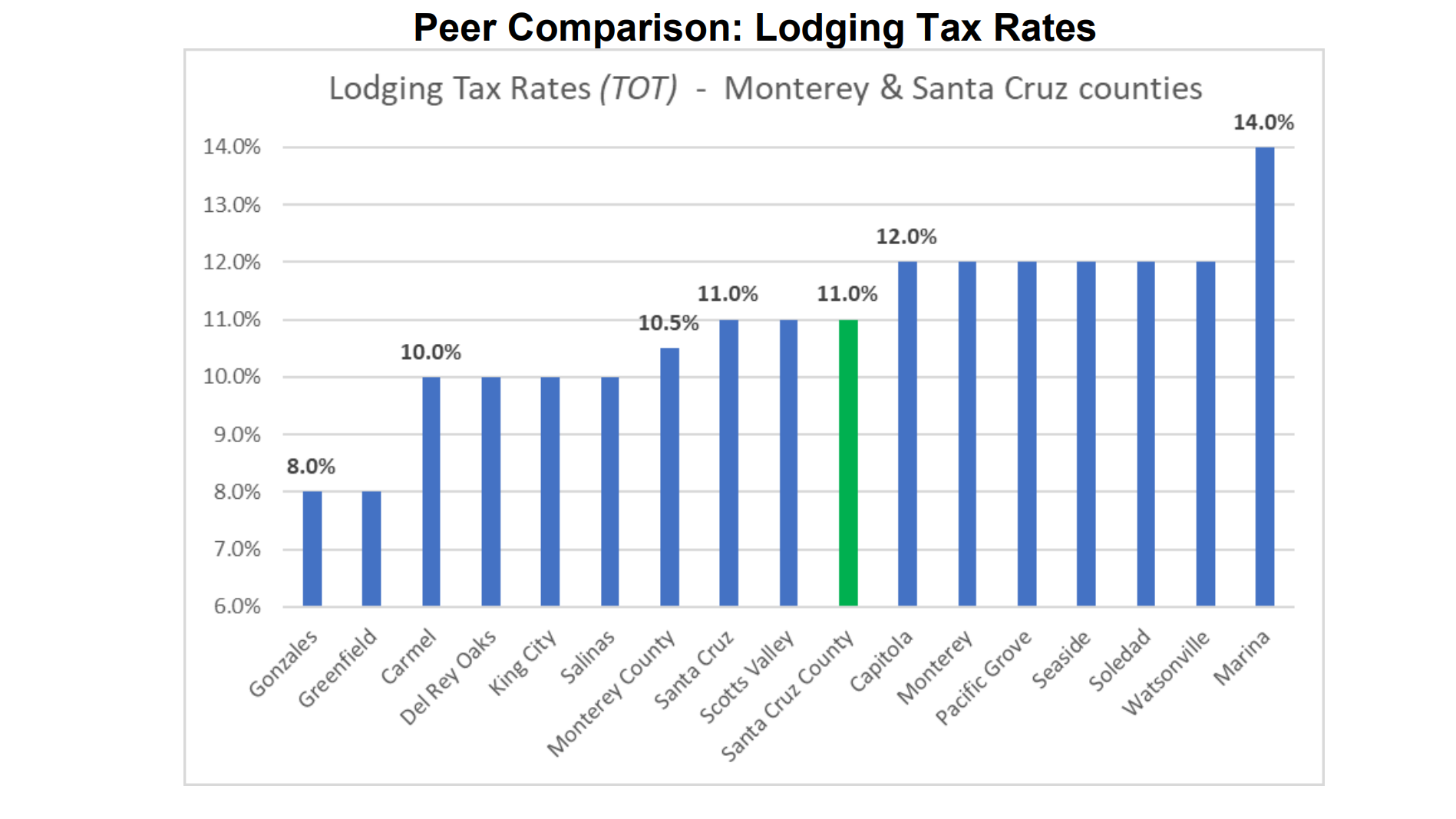

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales.

. 2022 Property Statement E-Filing E-Filing Process. Agency Direct Charges Special Assessments. Monterey County collects on average 051 of a propertys.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Monterey County California is 775. Fiscal Year 2022-2023 Direct ChargeSpecial Assessment.

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of. Testing Locations and Information. Monterey County Property Tax Due Dates 2021.

2021 2021 2021 000 000 000 payments 831 755-5057 000 addr chgs 831 755-5035 valuations 831 755-5035 12000 exemptions 831 755-5035 tax rates 831 755-5040 000. July 2 Nov. Monterey county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property.

Start of the Countys fiscal year. The second payment is due september 1 2021. Period for filing claims for Senior Citizens Tax Assistance.

Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. The present value of real estate located within monterey is computed by county assessors. Just type in the exact address in the search bar below and instantly know the targeted propertys bill for the latest tax year.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in. 1-800-491-8003 - Direct line to ACI Payments Inc.

November 1 2021 to all property owners. CITIES TAX RATE Marina 2015 GO Refunding Bonds 0022180. As a result if your home is valued at 1000000 and the county tax.

Period during which County Board of Equalization accepts. Both numbers listed below offer service in English or Spanish. MONTEREY COUNTY TAX RATES FOR FISCAL YEAR 2020-2021 Rupa Shah CPA Auditor-Controller.

Note that 1095 is an effective tax rate. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent. The transfer tax is levied on a portion of the assessed value of a property that exceeds the countys property tax rate.

368799 2021 Property Taxes. Fort Ord 583802690 13403466 597206156 TOTAL 7005105261 706782311 7711887572 202122 Monterey County Tax Rates - 2 - Values By Taxing Agency. 1-831-755-5057 - Monterey County Tax Collectors main telephone number.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. July 1 Oct. Easily run a rapid Monterey County CA property tax search.

For all due dates if the date falls on a saturday sunday or county holiday the due date is extended to the following business. Where do Property Taxes Go. The median property tax in Maryland is 277400 per year for a home worth the median value of.

Tax Collection Town Of Geneva Walworth County Wisconsin

California Property Tax Calculator Smartasset

Monterey County Property Tax Guide Assessor Collector Records Search More

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

How To Transfer California Property Tax Base From Old Home To New

Prop 218 Benefit Assessment North County Fire Protection District

Property Tax By County Property Tax Calculator Rethority

Property Tax California H R Block

Assessor County Of San Luis Obispo

Property Tax By County Property Tax Calculator Rethority

Election Guide Measure B In Santa Cruz County Santa Cruz Local

Prop 218 Benefit Assessment North County Fire Protection District

Riverside County Ca Property Tax Search And Records Propertyshark

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

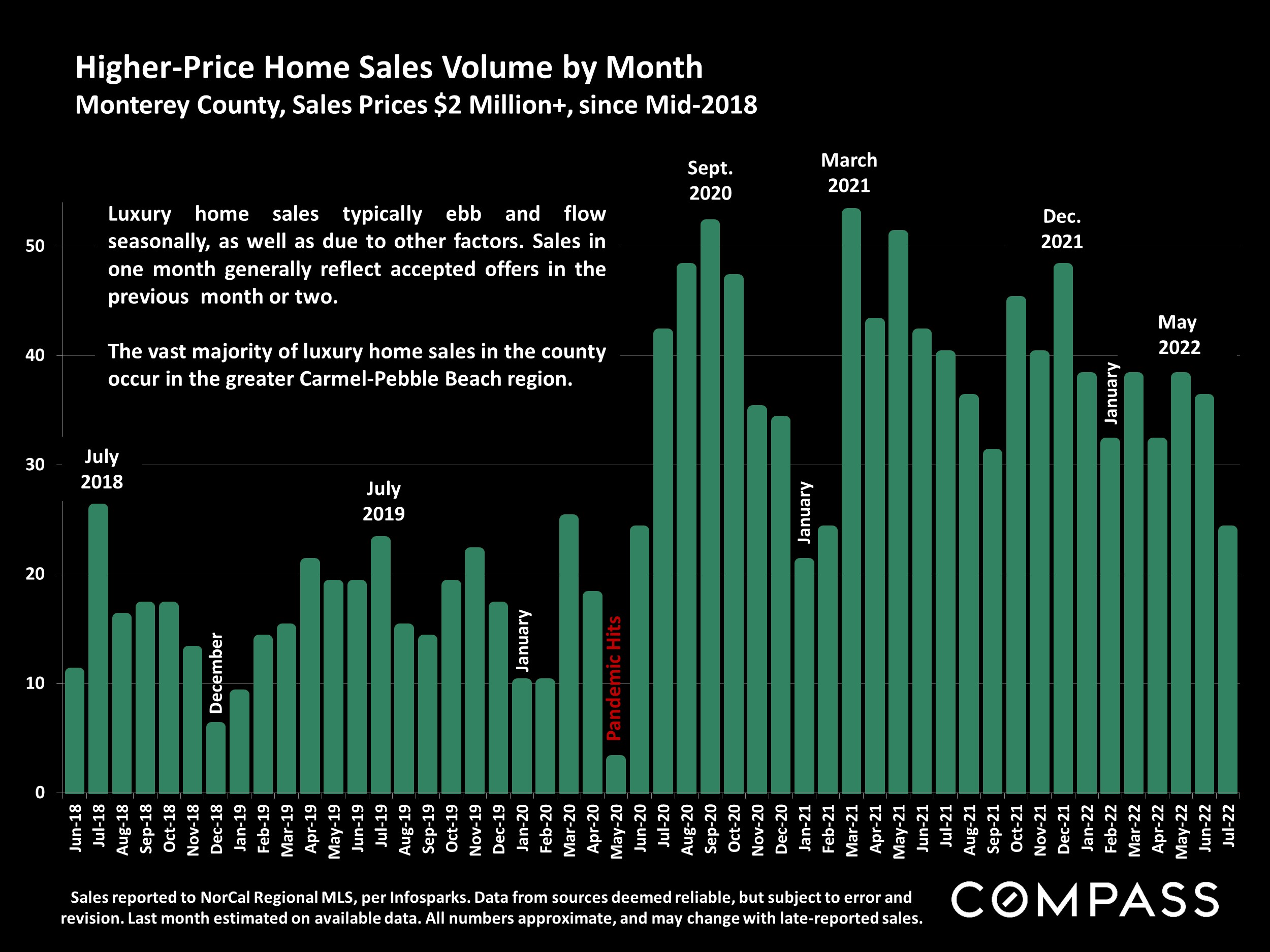

Monterey County Home Prices Market Trends Compass

Could Taxing Empty Homes Be A Tool In Creating More Affordable Rentals Cover Collections Montereycountyweekly Com

Arlington City Council Approves 2021 Budget Lowers Property Tax Rate For Fifth Straight Year